In the world of online businesses, getting paid for the things you sell is super important. But if your business is considered a bit risky, then it can be tough to find a way to get paid securely.

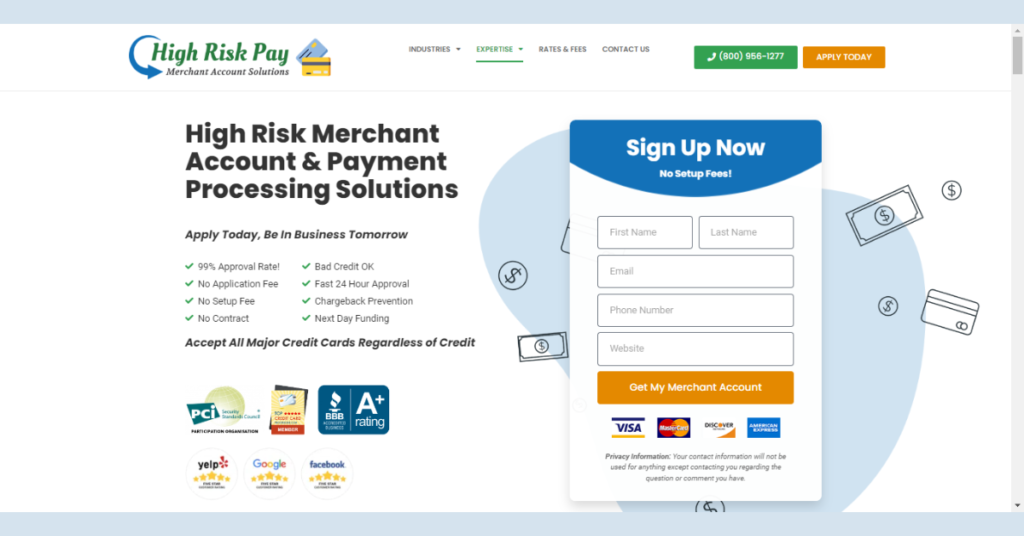

This is where HighRiskPay.com can be a real help. They specialize in making sure businesses that are seen as risky can still get paid safely.

In this article, we will take a closer look at high-risk merchant accounts, which are like special bank accounts for these types of businesses. At the end of this article, you will have a good understanding of how high-risk merchant accounts operate and why they are essential for the success of your business.

Table of Contents

What is a High-Risk Merchant Account?

When they call your business a high-risk merchant, it means your business does a lot of transactions. But that also means there is a higher chance of bad stuff happening, like fraud or people complaining about their payments.

That is where a high-risk merchant account from HighRiskPay.com comes in. It is like a special bank account that helps you deal with these problems and avoid losing money.

But here is the tricky part: getting this special account can be hard, especially if you run an online business. That is because you do not have a physical store, and that makes banks and payment companies worry about trusting you.

High-risk merchant accounts, like the ones at HighRiskPay.com, are like a shield that protects online businesses from fraud and disputes. They give you the support you need to keep your money safe and your business going strong.

How Does a High-Risk Merchant Account Work?

High-risk merchant accounts are like specialized tools for businesses in risky industries. These industries have more problems, like people asking for their money back a lot or being worried about fraud.

To get these special accounts, businesses go through a careful check by companies that know about these risky businesses. They look at the kind of business, how it is doing financially, and what rules it needs to follow.

Once approved, these special accounts let businesses safely take payments, like credit card transactions. The companies that give these accounts also make sure the money goes where it should and keep an eye out for any funny business to stop fraud.

Even though they can be a bit tricky, high-risk merchant accounts are really helpful for these businesses. They make it possible for them to do their job safely in industries that might have trouble getting regular payment accounts.

Why Online Businesses Really Need High-Risk Merchant Accounts

When you run a business on the Internet, there are some tough issues that only online businesses have to deal with like;

1. Fraud

Handling fraud is a big problem, especially for businesses in high-risk areas, particularly those working online.

Tricky fraud can happen in many ways, like fake payments that look real, using stolen credit cards, stealing someone’s identity, and customers saying they did not buy something when they did.

It is even tougher for online businesses because they can not see their customers in person. To help with these problems, special accounts called high-risk merchant accounts step in.

They add extra safety measures and tools to help businesses spot and stop tricky fraud online. These accounts are like a shield, guarding businesses in risky areas and keeping their money safe.

2. Customer Complaints

Customers sometimes complain in high-risk businesses, and this can cause money problems. These complaints happen for different reasons, like when customers are not happy with what they bought, have trouble with deliveries, or disagree about the charges.

The big issue is when these complaints turn into something called chargebacks. Chargebacks are when customers get their money back, and it can cost the business even more.

Dealing with these complaints takes time and resources away from what the business does best. But, high-risk merchant accounts often come with special tools to help businesses handle these complaints and save money.

These accounts act like a shield to protect businesses from the financial impact of complaints and let them focus on what they do well.

3. Global Reach

When your business is online, you can welcome customers from all over the world, and that is fantastic for your business’s growth.

However, it also brings some challenges. Different countries have their money systems, preferred ways of paying, and special rules for transactions. Adapting to these variations can be tricky for online businesses.

To make things easy, high-risk merchant accounts are like helpful guides. They know how to deal with all these different money and rules, making it easier for your business to accept payments from people in different places without any trouble.

These accounts connect your business to the world, making sure everything runs smoothly and follows the right financial rules.

Benefits of a High-Risk Merchant Account at highriskpay.com

HighRiskPay.com is a good choice for your high-risk business. They have a lot of experience and a good reputation in the industry. Here are some reasons why:

1. Reliable

HighRiskPay.com is a reliable choice for high-risk businesses because they have a lot of experience. They really understand the industry well. They have been doing this for a long time, and that is why they are so good at it.

They know all the challenges that high-risk businesses face, and they have proven they can handle them. When you pick HighRiskPay.com, you are getting a partner with the know-how to help your business succeed in tough situations.

2. Customer Service

HighRiskPay.com is proud of its helpful customer support. They truly care about their clients and are always ready to assist when you need help the most. Their customer support team is known for being attentive and responsive.

Whether you have questions or concerns or run into any issues, they are there to lend a helping hand. They make your journey in the high-risk business world easier and more successful.

3. Customized Solution

HighRiskPay.com understands that every high-risk business is different, and that is really good. They do not offer just one solution for everyone.

Instead, they have different options that they can customize to suit your business, whether you are in e-commerce, gaming, or another high-risk area.

This means your business can not only survive but do well because you get solutions that fit your needs perfectly. HighRiskPay.com makes sure you have the right tools and support to succeed in your specific high-risk industry.

4. Transparency

HighRiskPay.com is different because they want everything to be simple and open. They do not hide anything from you.

Their fees and rules are easy to understand so that you won’t be caught off guard by unexpected costs. With HighRiskPay.com, you can trust that they are looking out for you and your business, making everything easier and more predictable.

5. Many Payment Option

HighRiskPay.com wants to make things easy for your customers. They offer lots of ways to pay, like credit cards, digital wallets, and bank transfers.

This means your customers can choose the payment method they like best. It is all about giving your customers options and making it simple for them to shop with you.

Drawbacks of High-Risk Merchant Account

the disadvantages of using a high-risk merchant account may include:

1. Higher Fees

Extra charges that come with high-risk merchant accounts can be a problem for businesses. These added costs can eat into the money they make, making it hard for high-risk businesses to stay profitable.

It can also make them less competitive than businesses in safer industries, where customers want better prices. High-risk businesses need to understand and manage these costs well to stay financially healthy and competitive.

2. Financial Struggles for Small High-Risk Businesses

For small businesses, especially startups, facing high fees with high-risk merchant accounts can be quite tough. Every penny is important for these growing businesses, and the extra charges can have a big impact on their finances.

It might make it difficult for them to invest in things like getting bigger, advertising, or buying things they need to succeed.

3. High-Risk Account Rules and Chargeback Limits

High-risk merchant accounts come with stricter rules, including something called a chargeback threshold. Think of it as a limit on how many times customers can ask for their money back. If you go over this limit, your account could be temporarily stopped or even closed.

This is a big risk because it means your business can not continue. It is like a warning sign for high-risk businesses to be really careful.

Conclusion

HighRiskPay.com is a reliable tool for businesses dealing with tricky online transactions, especially those in riskier fields. They offer a special bank account, called a High-Risk Merchant Account, which works like a shield to protect businesses from problems like fraud and customer complaints.

With their experience, they are well-prepared to help your business thrive, even in challenging situations. So, when it comes to high-risk businesses, HighRiskPay.com is a reliable partner you can trust.